Investing can be as exhilarating. From choosing the right stocks to understanding market trends, every moment is filled with decisions that could potentially change your financial future.

It's a game where knowledge, strategy, and timing all play crucial roles. But imagine if you had an AI assisting you in this journey.

In this post, I will show you a series of ChatGPT prompts designed for investors. These prompts will help you make sense of market data, inform your investment decisions, and even automate some of your routine tasks.

Whether you're a seasoned investor or a beginner, these prompts will be invaluable tools in your investing arsenal.

These are the best ChatGPT Prompts for investing:

- Analyse market trends

- Analyze stock performance

- Identify investment opportunities

- Interpret market news

- Interpret economic indicators

- Suggest diversification strategies

- Identify market risks

- Perform portfolio risk assessment

In the next section, we'll take a closer look at each aspect of investing (along with the prompt examples). And if you read till the end, you'll also find a little tip to use these prompts more effectively.

ChatGPT Prompts for Investing

In this section, you'll find top-tier ChatGPT prompts to help you on your investing journey.

1. To Analyse Market Trends

Investing isn't just about buying low and selling high. It's about understanding and analyzing market trends to make informed decisions. And that's exactly what the first prompt is designed for.

As an investor with 50 years of experience, provide a comprehensive analysis of the current market trends in the [industry]. Your analysis should include identifying key growth areas, potential risks, and emerging opportunities based on current and forecasted market conditions. You should use your extensive investment experience to provide insights and recommendations for future investment strategies. Your analysis should be presented in a clear and concise report that can be understood by both industry experts and those less familiar with the industry.This prompt was generated by our ChatGPT prompt generator.

Example ChatGPT response:

As an investor with 50 years of experience, provide a comprehensive analysis of the current market trends in the [industry]. Your analysis should include identifying key growth areas, potential risks, and emerging opportunities based on current and forecasted market conditions. You should use your extensive investment experience to provide insights and recommendations for future investment strategies. Your analysis should be presented in a clear and concise report that can be understood by both industry experts and those less familiar with the industry.

To tailor the analysis and provide the most relevant insights, could you specify which industry you'd like the report to focus on?

As an investor with 50 years of experience, provide a comprehensive analysis of the current market trends in the [industry]. Your analysis should include identifying key growth areas, potential risks, and emerging opportunities based on current and forecasted market conditions. You should use your extensive investment experience to provide insights and recommendations for future investment strategies. Your analysis should be presented in a clear and concise report that can be understood by both industry experts and those less familiar with the industry.

To tailor the analysis and provide the most relevant insights, could you specify which industry you'd like the report to focus on?

2. To Analyze Stock Performance

Analyzing stock performance is a crucial step for every investor aiming to make informed decisions. But, it's not easy, especially when you face a sea of numbers and reports.

The next prompt is designed to make this process easier.

Act as an investor with 50 years of experience. Provide a comprehensive analysis of the given [stock]. This should include a thorough evaluation of the company's financial health, its competitive position in the industry, and any macroeconomic factors that could impact its performance. The analysis should also include an assessment of the stock's valuation, taking into account its projected earnings growth and other key financial metrics. Based on your analysis, provide a recommendation on whether to buy, hold, or sell the stock. Your analysis should be backed with supporting data and reasoning.This prompt was generated by our ChatGPT prompt generator.

Example ChatGPT response:

Act as an investor with 50 years of experience. Provide a comprehensive analysis of the given [stock]. This should include a thorough evaluation of the company's financial health, its competitive position in the industry, and any macroeconomic factors that could impact its performance. The analysis should also include an assessment of the stock's valuation, taking into account its projected earnings growth and other key financial metrics. Based on your analysis, provide a recommendation on whether to buy, hold, or sell the stock. Your analysis should be backed with supporting data and reasoning.

To provide a comprehensive analysis, I'll need the name or ticker symbol of the specific stock you're interested in. Could you please provide that information?

Act as an investor with 50 years of experience. Provide a comprehensive analysis of the given [stock]. This should include a thorough evaluation of the company's financial health, its competitive position in the industry, and any macroeconomic factors that could impact its performance. The analysis should also include an assessment of the stock's valuation, taking into account its projected earnings growth and other key financial metrics. Based on your analysis, provide a recommendation on whether to buy, hold, or sell the stock. Your analysis should be backed with supporting data and reasoning.

To provide a comprehensive analysis, I'll need the name or ticker symbol of the specific stock you're interested in. Could you please provide that information?

3. To Identify Investment Opportunities

The next prompt is to find the right investment opportunity. Because as every investor knows, it can often feel like looking for a needle in a haystack.

Leverage your 50 years of experience as an investor to identify potential investment opportunities within the given [industry]. Utilize your extensive knowledge and understanding of market trends, financial analysis, and risk management to assess potential opportunities. The task involves conducting comprehensive industry research, evaluating company financials, and assessing potential risks and returns. You need to prepare a detailed report outlining the most promising opportunities, your rationale for selection, and potential risks and mitigation strategies.This prompt was generated by our ChatGPT prompt generator.

Example ChatGPT response:

Leverage your 50 years of experience as an investor to identify potential investment opportunities within the given [industry]. Utilize your extensive knowledge and understanding of market trends, financial analysis, and risk management to assess potential opportunities. The task involves conducting comprehensive industry research, evaluating company financials, and assessing potential risks and returns. You need to prepare a detailed report outlining the most promising opportunities, your rationale for selection, and potential risks and mitigation strategies.

To provide a detailed report for identifying potential investment opportunities in a specific industry, I would go through a structured process involving industry analysis, company evaluation, and risk assessment. Here’s a step-by-step outline of how I would approach this task:

1. Industry Research

- Market Trends: Analyze current trends and future projections in the industry. This includes technological advancements, regulatory changes, consumer behavior shifts, and economic factors.

- Competitive Landscape: Identify key players, market share dynamics, and emerging competitors. Examine how companies differentiate themselves in terms of products, services, and strategies.

- Growth Potential: Assess the industry's growth potential by looking at historical growth rates, projected demand, and any macroeconomic factors influencing the industry.

2. Company Evaluation

- Financial Analysis: Conduct a thorough analysis of company financials, including revenue growth, profitability, cash flow, and balance sheet strength. Key metrics may include P/E ratio, EBITDA, ROE, and debt-to-equity ratio.

- Management and Strategy: Evaluate the effectiveness of the company's management team and their strategic vision. Consider past performance, leadership stability, and innovation capability.

- Competitive Advantage: Identify each company’s unique strengths or moat, such as patents, brand reputation, or cost leadership.

3. Risk Assessment

- Market Risks: Consider risks like market volatility, economic downturns, and changes in consumer demand.

- Operational Risks: Assess risks related to supply chain disruptions, technological failures, or changes in regulation.

- Financial Risks: Evaluate risks such as high debt levels, currency fluctuations, or exposure to interest rate changes.

4. Identification of Opportunities

- Promising Companies: Based on the above analyses, shortlist companies that show strong fundamentals, growth potential, and a competitive edge.

- Valuation: Determine if these companies are undervalued or fairly priced, using valuation models like DCF (Discounted Cash Flow) or comparables analysis.

5. Rationale and Risk Mitigation Strategies

- Rationale: For each selected company, provide a clear rationale for investment. This should include expected returns, growth drivers, and how the company fits into the broader market trends.

- Risk Mitigation: Develop strategies to mitigate identified risks, such as diversification, hedging, or setting stop-loss orders.

6. Report Preparation

- Executive Summary: Summarize key findings and recommendations.

- Detailed Analysis: Present detailed insights on industry trends, company evaluations, and risk assessments.

- Conclusion: Offer a final recommendation on the most promising investment opportunities with a balanced view of potential gains and risks.

If you can specify the industry you are interested in, I can tailor this approach to provide insights specific to that sector.

Leverage your 50 years of experience as an investor to identify potential investment opportunities within the given [industry]. Utilize your extensive knowledge and understanding of market trends, financial analysis, and risk management to assess potential opportunities. The task involves conducting comprehensive industry research, evaluating company financials, and assessing potential risks and returns. You need to prepare a detailed report outlining the most promising opportunities, your rationale for selection, and potential risks and mitigation strategies.

To provide a detailed report for identifying potential investment opportunities in a specific industry, I would go through a structured process involving industry analysis, company evaluation, and risk assessment. Here’s a step-by-step outline of how I would approach this task:

1. Industry Research

- Market Trends: Analyze current trends and future projections in the industry. This includes technological advancements, regulatory changes, consumer behavior shifts, and economic factors.

- Competitive Landscape: Identify key players, market share dynamics, and emerging competitors. Examine how companies differentiate themselves in terms of products, services, and strategies.

- Growth Potential: Assess the industry's growth potential by looking at historical growth rates, projected demand, and any macroeconomic factors influencing the industry.

2. Company Evaluation

- Financial Analysis: Conduct a thorough analysis of company financials, including revenue growth, profitability, cash flow, and balance sheet strength. Key metrics may include P/E ratio, EBITDA, ROE, and debt-to-equity ratio.

- Management and Strategy: Evaluate the effectiveness of the company's management team and their strategic vision. Consider past performance, leadership stability, and innovation capability.

- Competitive Advantage: Identify each company’s unique strengths or moat, such as patents, brand reputation, or cost leadership.

3. Risk Assessment

- Market Risks: Consider risks like market volatility, economic downturns, and changes in consumer demand.

- Operational Risks: Assess risks related to supply chain disruptions, technological failures, or changes in regulation.

- Financial Risks: Evaluate risks such as high debt levels, currency fluctuations, or exposure to interest rate changes.

4. Identification of Opportunities

- Promising Companies: Based on the above analyses, shortlist companies that show strong fundamentals, growth potential, and a competitive edge.

- Valuation: Determine if these companies are undervalued or fairly priced, using valuation models like DCF (Discounted Cash Flow) or comparables analysis.

5. Rationale and Risk Mitigation Strategies

- Rationale: For each selected company, provide a clear rationale for investment. This should include expected returns, growth drivers, and how the company fits into the broader market trends.

- Risk Mitigation: Develop strategies to mitigate identified risks, such as diversification, hedging, or setting stop-loss orders.

6. Report Preparation

- Executive Summary: Summarize key findings and recommendations.

- Detailed Analysis: Present detailed insights on industry trends, company evaluations, and risk assessments.

- Conclusion: Offer a final recommendation on the most promising investment opportunities with a balanced view of potential gains and risks.

If you can specify the industry you are interested in, I can tailor this approach to provide insights specific to that sector.

4. To Interpret Market News

Investing is as much about understanding the market news as it is about knowing where to put your money. With the prompt below, you'll be able to interpret market news and make informed investment decisions.

As an experienced investor with 50 years of expertise, analyze and explain how the [recent news] could potentially affect the market. Leverage your deep understanding of market trends, historical data, and economic indicators to provide a comprehensive analysis. The explanation should include potential short-term and long-term impacts, the sectors that could be affected, and any possible opportunities or risks for investors. The aim is to provide a clear and insightful analysis that aids in making informed investment decisions.This prompt was generated by our ChatGPT prompt generator.

Example ChatGPT response:

As an experienced investor with 50 years of expertise, analyze and explain how the [recent news] could potentially affect the market. Leverage your deep understanding of market trends, historical data, and economic indicators to provide a comprehensive analysis. The explanation should include potential short-term and long-term impacts, the sectors that could be affected, and any possible opportunities or risks for investors. The aim is to provide a clear and insightful analysis that aids in making informed investment decisions.

I'd be glad to help with that analysis. However, I need a bit more detail on the specific "recent news" you're referring to, as this will guide the analysis. Please provide more context or specify the news event, and I'll offer a detailed examination of its potential market impacts.

As an experienced investor with 50 years of expertise, analyze and explain how the [recent news] could potentially affect the market. Leverage your deep understanding of market trends, historical data, and economic indicators to provide a comprehensive analysis. The explanation should include potential short-term and long-term impacts, the sectors that could be affected, and any possible opportunities or risks for investors. The aim is to provide a clear and insightful analysis that aids in making informed investment decisions.

I'd be glad to help with that analysis. However, I need a bit more detail on the specific "recent news" you're referring to, as this will guide the analysis. Please provide more context or specify the news event, and I'll offer a detailed examination of its potential market impacts.

5. To Interpret Economic Indicators

Decoding news is hard, but it's nothing compared to making sense of economic indicators. However, understanding economic indicators is vital when making investment decisions, as they can provide a snapshot of a country's economic health.

With the prompt below, you'll be able to interpret these indicators with greater ease.

As an investor with 50 years of experience, your task is to analyze and explain the impact of the [latest changes] in the given [economic indicator] on the given [market]. The explanation should include an interpretation of the indicator's recent trends, their implications for different sectors, potential risks and opportunities for investors, and a prediction of future market behavior based on your analysis. You should also provide strategic advice on how to navigate the market under these conditions. Your insights should be informed by your extensive experience and deep understanding of market dynamics.This prompt was generated by our ChatGPT prompt generator.

Example ChatGPT response:

As an investor with 50 years of experience, your task is to analyze and explain the impact of the [latest changes] in the given [economic indicator] on the given [market]. The explanation should include an interpretation of the indicator's recent trends, their implications for different sectors, potential risks and opportunities for investors, and a prediction of future market behavior based on your analysis. You should also provide strategic advice on how to navigate the market under these conditions. Your insights should be informed by your extensive experience and deep understanding of market dynamics.

To provide a comprehensive analysis, please specify the economic indicator you're interested in and the market you want to focus on. With that information, I can offer a detailed evaluation of the indicator's recent trends, their implications, and strategic advice for navigating the market.

As an investor with 50 years of experience, your task is to analyze and explain the impact of the [latest changes] in the given [economic indicator] on the given [market]. The explanation should include an interpretation of the indicator's recent trends, their implications for different sectors, potential risks and opportunities for investors, and a prediction of future market behavior based on your analysis. You should also provide strategic advice on how to navigate the market under these conditions. Your insights should be informed by your extensive experience and deep understanding of market dynamics.

To provide a comprehensive analysis, please specify the economic indicator you're interested in and the market you want to focus on. With that information, I can offer a detailed evaluation of the indicator's recent trends, their implications, and strategic advice for navigating the market.

6. To Suggest Diversification Strategies

The next prompt will help diversify your strategies. Because as we know, diversifying your investment portfolio is crucial for managing risk and potential returns.

With the ChatGPT prompt that comes next, you can not only come up with suitable diversification strategies but also understand how to apply them in different market situations.

As an investor with 50 years of experience, you are required to suggest strategies for diversifying an investment portfolio that is currently focused on [industry]. Your task involves researching potential investment opportunities in various sectors, analyzing their risk and return profiles, and recommending a balanced mix of assets to reduce risk and maximize returns. The proposed strategies should be well-informed, practical, and tailored to the investor's financial goals and risk tolerance.This prompt was generated by our ChatGPT prompt generator.

Example ChatGPT response:

As an investor with 50 years of experience, you are required to suggest strategies for diversifying an investment portfolio that is currently focused on [industry]. Your task involves researching potential investment opportunities in various sectors, analyzing their risk and return profiles, and recommending a balanced mix of assets to reduce risk and maximize returns. The proposed strategies should be well-informed, practical, and tailored to the investor's financial goals and risk tolerance.

To effectively diversify an investment portfolio currently focused on a single industry, it's crucial to explore opportunities across various sectors and asset classes. Here’s a structured approach to achieve this:

1. Assessment of Current Portfolio and Investor Profile

- Understand Current Investments: Assess the current industry concentration to identify potential risks specific to that sector.

- Investor Profile: Consider the investor’s financial goals, risk tolerance, time horizon, and liquidity needs.

2. Research and Analysis of Sectors

- Identify Promising Sectors: Look for sectors with growth potential that are less correlated with the current industry. For example, if the current focus is on technology, consider sectors like healthcare, renewable energy, or consumer goods.

- Risk and Return Profiles: Analyze historical performance, volatility, and future outlook for each sector.

- Macroeconomic Trends: Consider how broader economic factors, such as inflation, interest rates, and geopolitical events, might impact these sectors.

3. Diversification Strategies

- Equity Diversification: Invest in a mix of large-cap, mid-cap, and small-cap stocks across different sectors. Consider international equities to gain exposure to global markets.

- Fixed Income: Include government and corporate bonds to provide stability and income. Diversify by duration and credit quality.

- Real Assets: Consider investments in real estate, commodities (like gold or oil), or infrastructure projects for inflation protection and diversification.

- Alternative Investments: Explore hedge funds, private equity, or venture capital, which often have low correlation with traditional asset classes.

4. Implementation and Monitoring

- Asset Allocation: Create a balanced mix based on risk tolerance. For a moderate risk profile, a 60/40 split between equities and bonds could be a starting point.

- Regular Review: Continuously monitor performance and rebalance the portfolio as needed to maintain desired asset allocation.

- Tax Considerations: Be mindful of tax implications when making investment decisions, such as capital gains or dividends.

5. Practical Recommendations

- Exchange-Traded Funds (ETFs) and Mutual Funds: Use these to gain broad exposure to different sectors and asset classes with lower costs and increased liquidity.

- Dividend Stocks: Consider companies with strong dividend histories for steady income.

- ESG Investments: Look into environmental, social, and governance-focused funds, which are becoming more important to investors and can offer growth opportunities.

By following these strategies, the investor can achieve a well-diversified portfolio that balances risk and maximizes potential returns, aligning with their long-term financial goals.

As an investor with 50 years of experience, you are required to suggest strategies for diversifying an investment portfolio that is currently focused on [industry]. Your task involves researching potential investment opportunities in various sectors, analyzing their risk and return profiles, and recommending a balanced mix of assets to reduce risk and maximize returns. The proposed strategies should be well-informed, practical, and tailored to the investor's financial goals and risk tolerance.

To effectively diversify an investment portfolio currently focused on a single industry, it's crucial to explore opportunities across various sectors and asset classes. Here’s a structured approach to achieve this:

1. Assessment of Current Portfolio and Investor Profile

- Understand Current Investments: Assess the current industry concentration to identify potential risks specific to that sector.

- Investor Profile: Consider the investor’s financial goals, risk tolerance, time horizon, and liquidity needs.

2. Research and Analysis of Sectors

- Identify Promising Sectors: Look for sectors with growth potential that are less correlated with the current industry. For example, if the current focus is on technology, consider sectors like healthcare, renewable energy, or consumer goods.

- Risk and Return Profiles: Analyze historical performance, volatility, and future outlook for each sector.

- Macroeconomic Trends: Consider how broader economic factors, such as inflation, interest rates, and geopolitical events, might impact these sectors.

3. Diversification Strategies

- Equity Diversification: Invest in a mix of large-cap, mid-cap, and small-cap stocks across different sectors. Consider international equities to gain exposure to global markets.

- Fixed Income: Include government and corporate bonds to provide stability and income. Diversify by duration and credit quality.

- Real Assets: Consider investments in real estate, commodities (like gold or oil), or infrastructure projects for inflation protection and diversification.

- Alternative Investments: Explore hedge funds, private equity, or venture capital, which often have low correlation with traditional asset classes.

4. Implementation and Monitoring

- Asset Allocation: Create a balanced mix based on risk tolerance. For a moderate risk profile, a 60/40 split between equities and bonds could be a starting point.

- Regular Review: Continuously monitor performance and rebalance the portfolio as needed to maintain desired asset allocation.

- Tax Considerations: Be mindful of tax implications when making investment decisions, such as capital gains or dividends.

5. Practical Recommendations

- Exchange-Traded Funds (ETFs) and Mutual Funds: Use these to gain broad exposure to different sectors and asset classes with lower costs and increased liquidity.

- Dividend Stocks: Consider companies with strong dividend histories for steady income.

- ESG Investments: Look into environmental, social, and governance-focused funds, which are becoming more important to investors and can offer growth opportunities.

By following these strategies, the investor can achieve a well-diversified portfolio that balances risk and maximizes potential returns, aligning with their long-term financial goals.

7. To Identify Market Risks

Identifying market risks is crucial to make sure your investments are safe. And with the help of ChatGPT, you can assess potential risks with a little more assurance. Here's a prompt that will help you do that.

As an investor with 50 years of experience, you are required to identify the top 5 risks associated with investing in the given [industry]. Utilize your extensive knowledge and experience to thoroughly analyze the current market trends, economic factors, regulatory environment, and potential challenges specific to the [industry]. Your analysis should result in a comprehensive list of the top 5 risks that an investor would face when investing in this industry. Each risk should be clearly defined and include a detailed explanation of why it is a significant concern.This prompt was generated by our ChatGPT prompt generator.

Example ChatGPT response:

As an investor with 50 years of experience, you are required to identify the top 5 risks associated with investing in the given [industry]. Utilize your extensive knowledge and experience to thoroughly analyze the current market trends, economic factors, regulatory environment, and potential challenges specific to the [industry]. Your analysis should result in a comprehensive list of the top 5 risks that an investor would face when investing in this industry. Each risk should be clearly defined and include a detailed explanation of why it is a significant concern.

To provide a detailed analysis of the top 5 risks associated with investing in a specific industry, I'll need you to specify the industry you're interested in. Each industry has unique characteristics and challenges, so pinpointing the risks requires a tailored approach. Could you please let me know which industry you're focused on?

As an investor with 50 years of experience, you are required to identify the top 5 risks associated with investing in the given [industry]. Utilize your extensive knowledge and experience to thoroughly analyze the current market trends, economic factors, regulatory environment, and potential challenges specific to the [industry]. Your analysis should result in a comprehensive list of the top 5 risks that an investor would face when investing in this industry. Each risk should be clearly defined and include a detailed explanation of why it is a significant concern.

To provide a detailed analysis of the top 5 risks associated with investing in a specific industry, I'll need you to specify the industry you're interested in. Each industry has unique characteristics and challenges, so pinpointing the risks requires a tailored approach. Could you please let me know which industry you're focused on?

8. To Perform Portfolio Risk Assessment

The last prompt we'll take a look at is to perform a risk assessment. By using it, you can perform a comprehensive risk assessment of your investment portfolio or any other portfolio.

As an experienced investor with 50 years of knowledge, you are tasked to assess the risk profile of my investment portfolio. Use your expertise to analyze each asset in the portfolio and evaluate their associated risks. Consider factors such as market volatility, liquidity risk, credit risk, and interest rate risk. Use historical data and future predictions to assess the potential performance of each asset. Provide a comprehensive report detailing your findings and recommendations for reducing risk and optimizing returns.This prompt was generated by our ChatGPT prompt generator.

Example ChatGPT response:

As an experienced investor with 50 years of knowledge, you are tasked to assess the risk profile of my investment portfolio. Use your expertise to analyze each asset in the portfolio and evaluate their associated risks. Consider factors such as market volatility, liquidity risk, credit risk, and interest rate risk. Use historical data and future predictions to assess the potential performance of each asset. Provide a comprehensive report detailing your findings and recommendations for reducing risk and optimizing returns.

To provide a thorough analysis of your investment portfolio and assess its risk profile, I'll need some detailed information about the assets in your portfolio. Please provide details such as:

- Asset Types: List the specific types of assets (e.g., stocks, bonds, real estate, commodities).

- Individual Holdings: Include the name of each asset and any relevant details (e.g., company name for stocks, bond issuer, type of real estate).

- Allocation: Specify the percentage or amount of your total portfolio that each asset represents.

- Investment Horizon: Share your expected time frame for holding these investments (e.g., short-term, long-term).

- Risk Tolerance: Describe your risk tolerance (e.g., conservative, moderate, aggressive).

- Current Market Conditions: Any specific market conditions or economic factors you're particularly concerned about.

With this information, I can analyze each asset's risk factors, such as market volatility, liquidity, credit, and interest rate risks, using historical data and future predictions to provide a comprehensive assessment.

As an experienced investor with 50 years of knowledge, you are tasked to assess the risk profile of my investment portfolio. Use your expertise to analyze each asset in the portfolio and evaluate their associated risks. Consider factors such as market volatility, liquidity risk, credit risk, and interest rate risk. Use historical data and future predictions to assess the potential performance of each asset. Provide a comprehensive report detailing your findings and recommendations for reducing risk and optimizing returns.

To provide a thorough analysis of your investment portfolio and assess its risk profile, I'll need some detailed information about the assets in your portfolio. Please provide details such as:

- Asset Types: List the specific types of assets (e.g., stocks, bonds, real estate, commodities).

- Individual Holdings: Include the name of each asset and any relevant details (e.g., company name for stocks, bond issuer, type of real estate).

- Allocation: Specify the percentage or amount of your total portfolio that each asset represents.

- Investment Horizon: Share your expected time frame for holding these investments (e.g., short-term, long-term).

- Risk Tolerance: Describe your risk tolerance (e.g., conservative, moderate, aggressive).

- Current Market Conditions: Any specific market conditions or economic factors you're particularly concerned about.

With this information, I can analyze each asset's risk factors, such as market volatility, liquidity, credit, and interest rate risks, using historical data and future predictions to provide a comprehensive assessment.

How to Use These Prompts Effectively

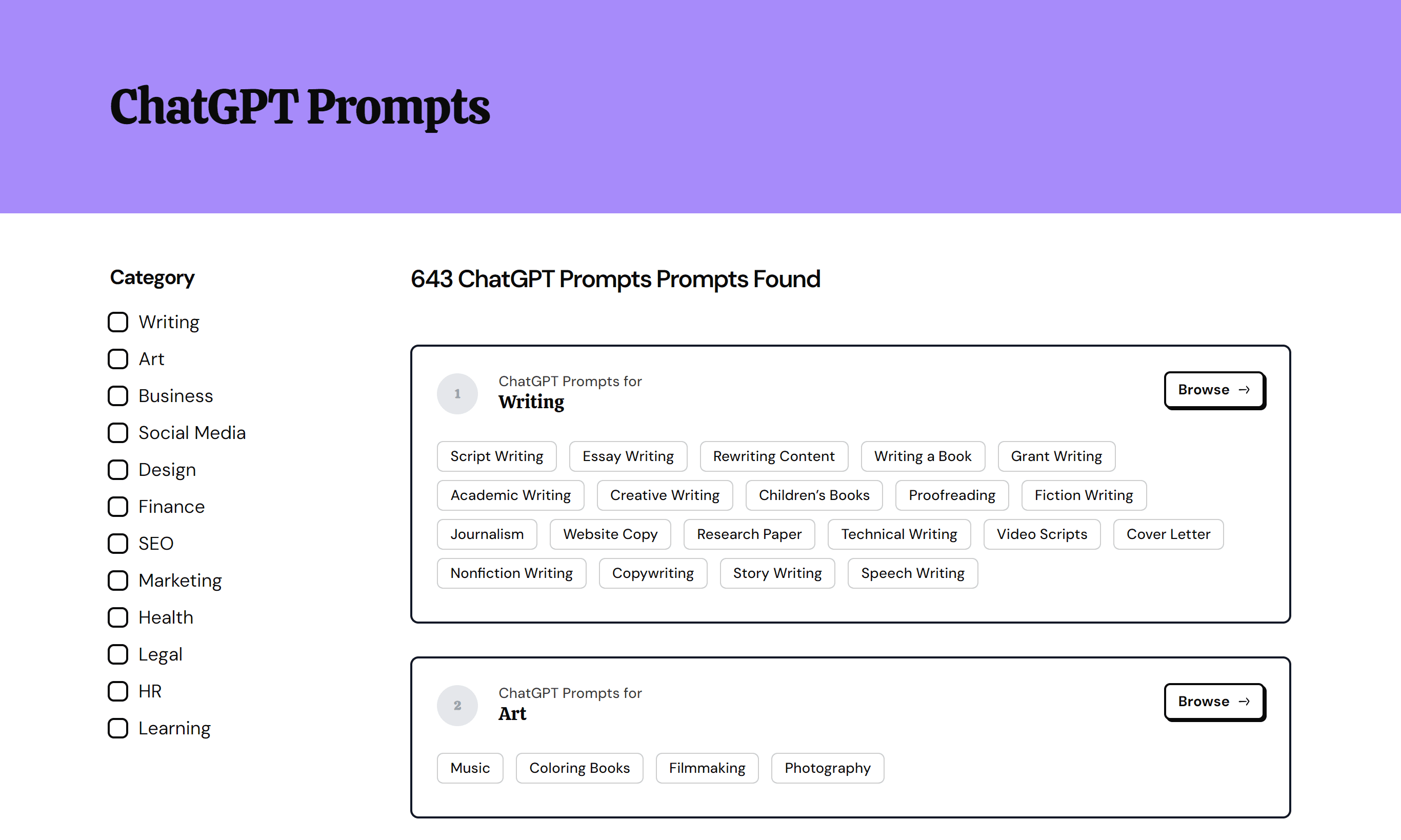

The prompts I mentioned today are also available in our FREE prompt directory. You can check them out here: ChatGPT prompts.

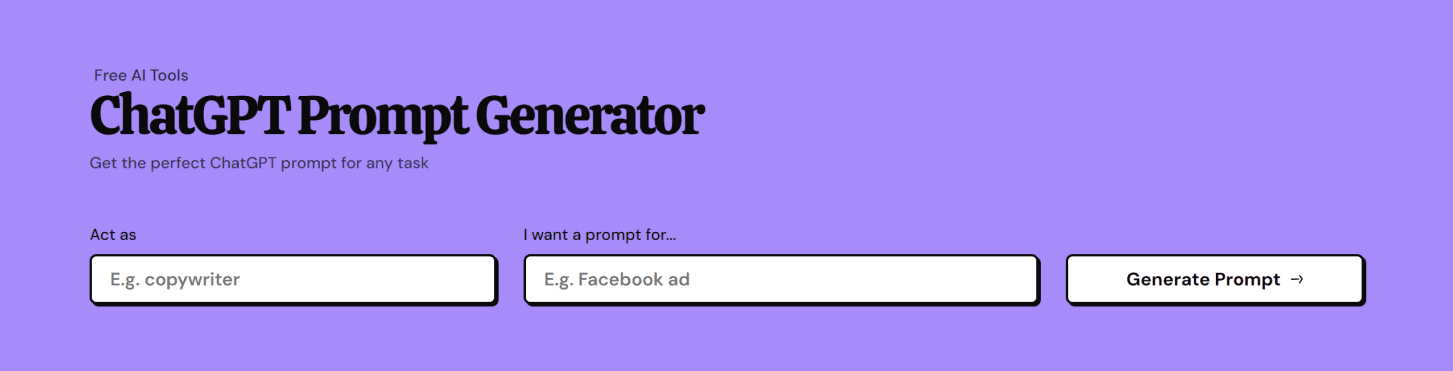

How To Generate Custom Prompts

Didn't find the prompt you need? Try our FREE ChatGPT Prompt Generator to generate one for you!

Final Thoughts

Investing is a journey that can be filled with complexities and uncertainties. However, with the ChatGPT prompts discussed in this post, you're now armed with tools that can simplify and enhance your investment strategies.

By using these prompts, you can gain better insights, make more informed investment decisions, and be better prepared for the ever-changing market.

FAQ

Let's also address some of the common questions about using ChatGPT for investing.

What is the use of ChatGPT in investing?

ChatGPT can be used to provide you with up-to-date financial news, analyze market trends, and interpret complex financial reports. However, it's important to remember that all investment decisions should be made with careful consideration and professional advice.

Can ChatGPT predict the stock market?

No, ChatGPT is not designed to predict the stock market. Investing in the stock market involves a high level of risk and uncertainty that even sophisticated AI systems like ChatGPT can't accurately forecast.