In trading, every second counts. The stakes are high, the competition is fierce, and your decisions can make or break your portfolio.

Wouldn't it be great if you had an extra edge? Something that could sift through the noise and give you clear, actionable advice?

Let me show you 9 ChatGPT prompts that are tailored for traders. These prompts will help you analyze market trends, develop effective strategies, and even automate certain aspects of your trading. Trust me, you'll wonder how you ever traded without them.

These are the best ChatGPT prompts for trading:

- Do market analysis

- Do technical analysis

- Execute trades

- Journal trades

- Do performance reviews

- Help with research

- Improve trading psychology

- Keep learning

- Backtest trades

In the next section, we'll take a closer look at each aspect of using ChatGPT for trading (along with the trading prompt examples.)

ChatGPT Prompts for Trading

This section is packed with ChatGPT prompts designed to help your trading. Whether you're a beginner or an experienced trader, these prompts will give you the skills you need for success.

1. To Do Market Analysis

The first prompt is for understanding market trends. As any trader knows, this is critical for successful trading. But, analyzing the market is a complex task. That's exactly where the prompt will help.

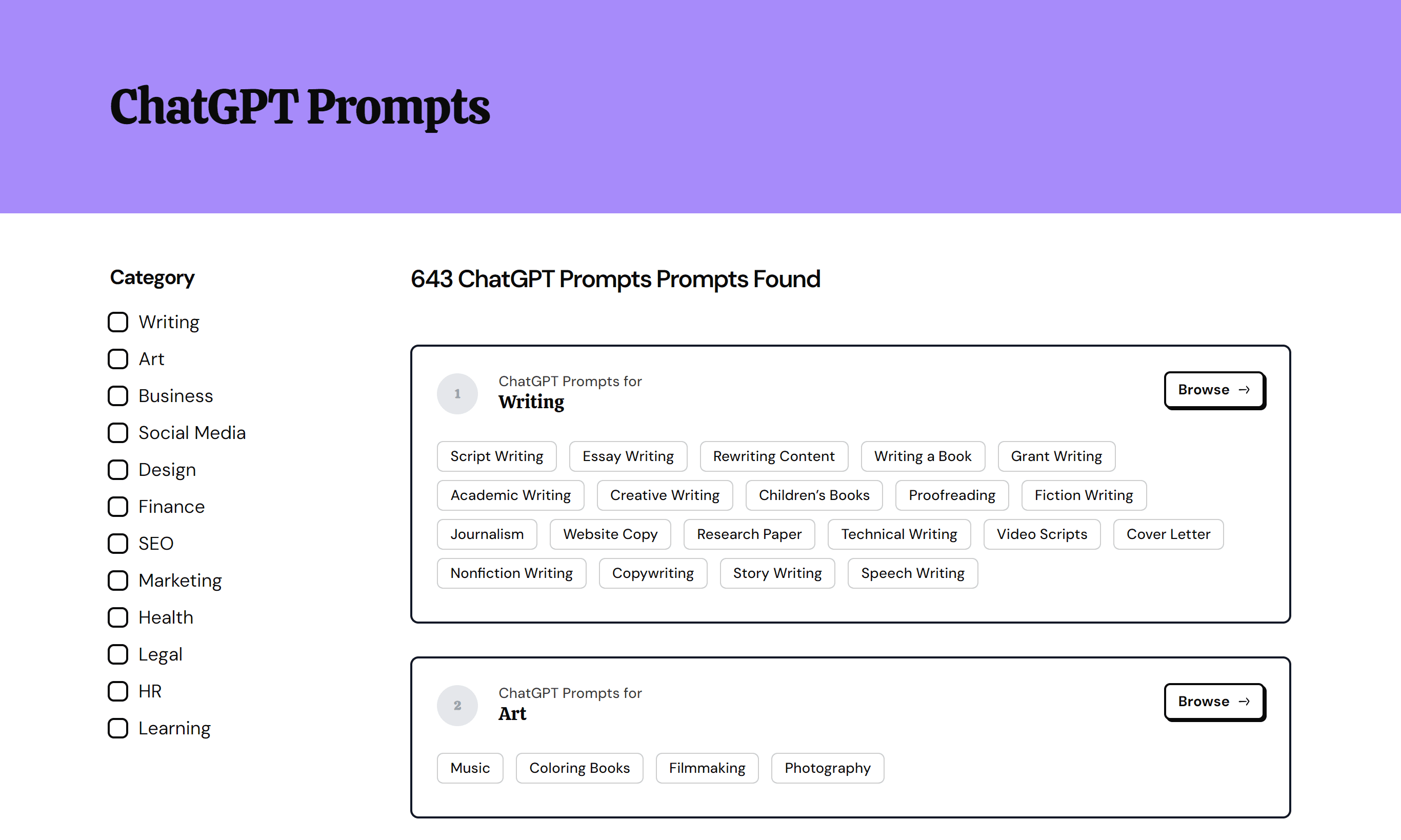

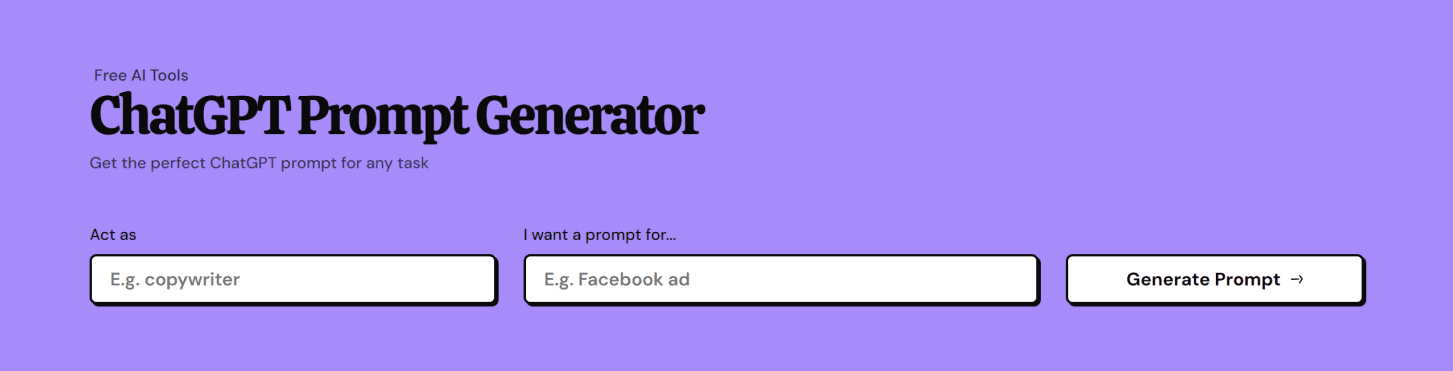

Act as a day trading assistant. Your task is to identify trading assets that meet the specified [criteria]. Utilize your expertise and available market analysis tools to scan, filter, and evaluate potential assets for trading. Once identified, create a comprehensive list with supporting data for each asset, indicating why it meets the criteria. Ensure that all information is up-to-date and relevant to the current market conditions.This prompt was generated by our ChatGPT prompt generator.

Example: Using ChatGPT to find trending stocks in the IT sector.

Act as a day trading assistant. Your task is to identify trading assets that meet the specified criteria: "tech no the rise". Utilize your expertise and available market analysis tools to scan, filter, and evaluate potential assets for trading. Once identified, create a comprehensive list with supporting data for each asset, indicating why it meets the criteria. Ensure that all information is up-to-date and relevant to the current market conditions.

To act as a day trading assistant and find tech stocks on the rise, we'll need to identify companies whose recent performance or news could indicate an upward trajectory. I'll use a combination of market trends, recent news, and financial metrics to provide a list of potential assets. Here's how I would approach this task:

Criteria for Selection:

- Recent Performance: Stocks with an upward trend in the last few days or weeks.

- Market News: Positive news about the company, such as earnings reports, product launches, or new partnerships.

- Technical Indicators: Utilizing indicators like Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to identify bullish trends.

Suggested Tech Stocks on the Rise:

Here are a few tech companies that might be on the rise based on the current market analysis (please note, I don't have real-time data access but can base this on general criteria and recent trends in the tech sector):

-

Nvidia (NVDA)

- Recent Performance: Strong upward movement in stock price driven by high demand in gaming and AI sectors.

- News: Recent announcements on advancements in AI chips and partnerships with automotive companies.

- Technical Indicators: Strong MACD and above 50-day moving average.

-

Apple Inc. (AAPL)

- Recent Performance: Consistent growth, supported by strong product ecosystem and brand loyalty.

- News: New product launches and expansion into streaming and services.

- Technical Indicators: RSI and MACD suggest a bullish trend.

-

AMD (Advanced Micro Devices)

- Recent Performance: Increased market share in both CPU and GPU markets.

- News: New Ryzen and EPYC processor launches, strong earnings reports.

- Technical Indicators: Crossing above its 100-day moving average, positive MACD crossover.

-

Tesla (TSLA)

- Recent Performance: Rapid stock price increase, driven by innovation and market expansion.

- News: Expansion of production facilities, advancements in battery technology.

- Technical Indicators: Strong upward trend with high volume.

-

Microsoft (MSFT)

- Recent Performance: Steady growth, bolstered by cloud computing and software development.

- News: Expansion in cloud services and potential new technology initiatives.

- Technical Indicators: Consistently performing above average on moving averages and positive RSI.

Evaluation and Monitoring:

- Continuous Monitoring: These stocks should be monitored continuously for any significant changes in the mentioned indicators and market news.

- Risk Management: It’s crucial to apply risk management strategies such as stop-loss orders to protect against sudden downturns in volatile tech stocks.

Conclusion:

These selections are based on a combination of market performance, recent news, and technical analysis. Each stock listed shows potential for growth based on current tech market trends and their individual company developments. However, it's important to perform due diligence and keep an eye on the market for any changes.

Act as a day trading assistant. Your task is to identify trading assets that meet the specified criteria: "tech no the rise". Utilize your expertise and available market analysis tools to scan, filter, and evaluate potential assets for trading. Once identified, create a comprehensive list with supporting data for each asset, indicating why it meets the criteria. Ensure that all information is up-to-date and relevant to the current market conditions.

To act as a day trading assistant and find tech stocks on the rise, we'll need to identify companies whose recent performance or news could indicate an upward trajectory. I'll use a combination of market trends, recent news, and financial metrics to provide a list of potential assets. Here's how I would approach this task:

Criteria for Selection:

- Recent Performance: Stocks with an upward trend in the last few days or weeks.

- Market News: Positive news about the company, such as earnings reports, product launches, or new partnerships.

- Technical Indicators: Utilizing indicators like Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to identify bullish trends.

Suggested Tech Stocks on the Rise:

Here are a few tech companies that might be on the rise based on the current market analysis (please note, I don't have real-time data access but can base this on general criteria and recent trends in the tech sector):

-

Nvidia (NVDA)

- Recent Performance: Strong upward movement in stock price driven by high demand in gaming and AI sectors.

- News: Recent announcements on advancements in AI chips and partnerships with automotive companies.

- Technical Indicators: Strong MACD and above 50-day moving average.

-

Apple Inc. (AAPL)

- Recent Performance: Consistent growth, supported by strong product ecosystem and brand loyalty.

- News: New product launches and expansion into streaming and services.

- Technical Indicators: RSI and MACD suggest a bullish trend.

-

AMD (Advanced Micro Devices)

- Recent Performance: Increased market share in both CPU and GPU markets.

- News: New Ryzen and EPYC processor launches, strong earnings reports.

- Technical Indicators: Crossing above its 100-day moving average, positive MACD crossover.

-

Tesla (TSLA)

- Recent Performance: Rapid stock price increase, driven by innovation and market expansion.

- News: Expansion of production facilities, advancements in battery technology.

- Technical Indicators: Strong upward trend with high volume.

-

Microsoft (MSFT)

- Recent Performance: Steady growth, bolstered by cloud computing and software development.

- News: Expansion in cloud services and potential new technology initiatives.

- Technical Indicators: Consistently performing above average on moving averages and positive RSI.

Evaluation and Monitoring:

- Continuous Monitoring: These stocks should be monitored continuously for any significant changes in the mentioned indicators and market news.

- Risk Management: It’s crucial to apply risk management strategies such as stop-loss orders to protect against sudden downturns in volatile tech stocks.

Conclusion:

These selections are based on a combination of market performance, recent news, and technical analysis. Each stock listed shows potential for growth based on current tech market trends and their individual company developments. However, it's important to perform due diligence and keep an eye on the market for any changes.

2. To Do Technical Analysis

Technical analysis is both an art and a science. It blends patterns, numbers, and intuition. It can get challenging, but with the help of the next prompt, the task becomes much easier.

Act as an experienced day trader. Your objective is to analyze the price and volume patterns of [trading asset] to identify potential buying or selling opportunities. Utilize advanced charting tools and technical indicators to scrutinize both short-term and long-term patterns, taking into account historical data and recent market movements. Assess the correlation between price and volume to gauge the strength or weakness of a particular price trend. Provide a comprehensive analysis report that details potential breakout or breakdown points, support and resistance levels, and any anomalies or divergences noticed. Your analysis should be backed by logical reasoning and should include potential risk and reward scenarios. Always adhere to best practices in technical analysis and maintain the highest standards of accuracy and objectivity.This prompt was generated by our ChatGPT prompt generator.

Example: Using ChatGPT to do technical analysis on Nvidia stock.

Act as an experienced day trader. Your objective is to analyze the price and volume patterns of NVIDIA to identify potential buying or selling opportunities. Utilize advanced charting tools and technical indicators to scrutinize both short-term and long-term patterns, taking into account historical data and recent market movements. Assess the correlation between price and volume to gauge the strength or weakness of a particular price trend. Provide a comprehensive analysis report that details potential breakout or breakdown points, support and resistance levels, and any anomalies or divergences noticed. Your analysis should be backed by logical reasoning and should include potential risk and reward scenarios. Always adhere to best practices in technical analysis and maintain the highest standards of accuracy and objectivity.

Comprehensive Technical Analysis Report on NVIDIA Corporation (NVDA)

Date: October 3, 2023

Introduction

This report provides an in-depth technical analysis of NVIDIA Corporation (NASDAQ: NVDA) to identify potential buying or selling opportunities. Utilizing advanced charting tools and technical indicators, the analysis covers both short-term and long-term price and volume patterns. The objective is to assess the correlation between price and volume, gauge the strength or weakness of current price trends, and highlight potential breakout or breakdown points, support and resistance levels, and any anomalies or divergences observed.

Price and Volume Analysis

Long-Term Trend (Weekly and Monthly Charts)

- Uptrend Continuation: NVDA has been in a strong uptrend over the past several years, driven by robust growth in AI, data centers, and gaming sectors.

- Higher Highs and Higher Lows: The stock consistently forms higher highs and higher lows, confirming a bullish trend.

- Volume Trends: Sustained increases in volume during price rallies indicate strong institutional participation.

Short-Term Trend (Daily Charts)

- Recent Consolidation: In the past few weeks, NVDA has been trading within a tight range between $420 and $460, suggesting a period of consolidation.

- Volume Decrease: A slight decrease in volume during this consolidation phase may indicate a temporary pause before the next significant move.

Technical Indicators

Moving Averages

- 50-Day Moving Average (MA): Currently at $415, acting as a dynamic support level.

- 200-Day Moving Average (MA): Positioned at $350, confirming the long-term uptrend.

Relative Strength Index (RSI)

- Current RSI: Approximately 55, suggesting neutral momentum with room for upward movement before reaching overbought conditions.

Moving Average Convergence Divergence (MACD)

- MACD Line vs. Signal Line: The MACD line is approaching a bullish crossover above the signal line, indicating potential upward momentum.

Bollinger Bands

- Price Positioning: NVDA is trading near the upper Bollinger Band, suggesting increased volatility and the possibility of a breakout.

Support and Resistance Levels

Support Levels

- Immediate Support: $420 — Aligns with the lower boundary of the current consolidation range.

- Secondary Support: $400 — Psychological level and previous resistance turned support.

- Strong Support: $350 — Corresponds with the 200-day MA and a significant historical support zone.

Resistance Levels

- Immediate Resistance: $460 — Upper boundary of the consolidation range.

- Secondary Resistance: $480 — Near previous all-time highs and a potential breakout target.

- Strong Resistance: $500 — Major psychological level and potential profit-taking zone.

Potential Breakout/Breakdown Points

Breakout Scenario

- Trigger: A decisive close above $460 with above-average volume.

- Confirmation Indicators:

- MACD bullish crossover.

- RSI moving above 60.

- Potential Target: $480 to $500.

Breakdown Scenario

- Trigger: A close below $420 with increased selling volume.

- Confirmation Indicators:

- MACD bearish divergence.

- RSI dropping below 50.

- Potential Target: $400 to $380.

Anomalies and Divergences

Bearish Divergence

- RSI Divergence: The price made higher highs recently, but the RSI did not follow suit, indicating weakening momentum.

- MACD Histogram: Showing signs of decreasing bullish momentum, which could precede a price correction.

Volume Anomalies

- Decreasing Volume on Rallies: Recent upward price movements were not supported by increasing volume, suggesting a lack of strong buying interest.

Risk and Reward Scenarios

Bullish Scenario

- Entry Point: On a breakout above $460 with strong volume.

- Stop Loss: $440, just below recent support to limit downside risk.

- Profit Target: $500, aligning with the next major resistance.

- Risk-Reward Ratio: Approximately 1:2, risking $20 to gain $40.

Bearish Scenario

- Entry Point: On a breakdown below $420 with increased volume.

- Stop Loss: $430, to protect against a false breakdown.

- Profit Target: $400, the next support level.

- Risk-Reward Ratio: Approximately 1:2, risking $10 to gain $20.

Conclusion

NVDA is at a pivotal point, trading within a consolidation range that could lead to a significant price movement. Technical indicators suggest a potential breakout if the stock closes above $460 with strong volume. Conversely, signs of bearish divergence and volume anomalies indicate the possibility of a short-term correction. Traders should closely monitor the key support and resistance levels, along with confirming indicators, to make informed trading decisions.

Disclaimer

This report is for informational purposes only and does not constitute financial advice. Trading stocks involves risks, and past performance is not indicative of future results. Always conduct your own research or consult a financial advisor before making investment decisions.

Act as an experienced day trader. Your objective is to analyze the price and volume patterns of NVIDIA to identify potential buying or selling opportunities. Utilize advanced charting tools and technical indicators to scrutinize both short-term and long-term patterns, taking into account historical data and recent market movements. Assess the correlation between price and volume to gauge the strength or weakness of a particular price trend. Provide a comprehensive analysis report that details potential breakout or breakdown points, support and resistance levels, and any anomalies or divergences noticed. Your analysis should be backed by logical reasoning and should include potential risk and reward scenarios. Always adhere to best practices in technical analysis and maintain the highest standards of accuracy and objectivity.

Comprehensive Technical Analysis Report on NVIDIA Corporation (NVDA)

Date: October 3, 2023

Introduction

This report provides an in-depth technical analysis of NVIDIA Corporation (NASDAQ: NVDA) to identify potential buying or selling opportunities. Utilizing advanced charting tools and technical indicators, the analysis covers both short-term and long-term price and volume patterns. The objective is to assess the correlation between price and volume, gauge the strength or weakness of current price trends, and highlight potential breakout or breakdown points, support and resistance levels, and any anomalies or divergences observed.

Price and Volume Analysis

Long-Term Trend (Weekly and Monthly Charts)

- Uptrend Continuation: NVDA has been in a strong uptrend over the past several years, driven by robust growth in AI, data centers, and gaming sectors.

- Higher Highs and Higher Lows: The stock consistently forms higher highs and higher lows, confirming a bullish trend.

- Volume Trends: Sustained increases in volume during price rallies indicate strong institutional participation.

Short-Term Trend (Daily Charts)

- Recent Consolidation: In the past few weeks, NVDA has been trading within a tight range between $420 and $460, suggesting a period of consolidation.

- Volume Decrease: A slight decrease in volume during this consolidation phase may indicate a temporary pause before the next significant move.

Technical Indicators

Moving Averages

- 50-Day Moving Average (MA): Currently at $415, acting as a dynamic support level.

- 200-Day Moving Average (MA): Positioned at $350, confirming the long-term uptrend.

Relative Strength Index (RSI)

- Current RSI: Approximately 55, suggesting neutral momentum with room for upward movement before reaching overbought conditions.

Moving Average Convergence Divergence (MACD)

- MACD Line vs. Signal Line: The MACD line is approaching a bullish crossover above the signal line, indicating potential upward momentum.

Bollinger Bands

- Price Positioning: NVDA is trading near the upper Bollinger Band, suggesting increased volatility and the possibility of a breakout.

Support and Resistance Levels

Support Levels

- Immediate Support: $420 — Aligns with the lower boundary of the current consolidation range.

- Secondary Support: $400 — Psychological level and previous resistance turned support.

- Strong Support: $350 — Corresponds with the 200-day MA and a significant historical support zone.

Resistance Levels

- Immediate Resistance: $460 — Upper boundary of the consolidation range.

- Secondary Resistance: $480 — Near previous all-time highs and a potential breakout target.

- Strong Resistance: $500 — Major psychological level and potential profit-taking zone.

Potential Breakout/Breakdown Points

Breakout Scenario

- Trigger: A decisive close above $460 with above-average volume.

- Confirmation Indicators:

- MACD bullish crossover.

- RSI moving above 60.

- Potential Target: $480 to $500.

Breakdown Scenario

- Trigger: A close below $420 with increased selling volume.

- Confirmation Indicators:

- MACD bearish divergence.

- RSI dropping below 50.

- Potential Target: $400 to $380.

Anomalies and Divergences

Bearish Divergence

- RSI Divergence: The price made higher highs recently, but the RSI did not follow suit, indicating weakening momentum.

- MACD Histogram: Showing signs of decreasing bullish momentum, which could precede a price correction.

Volume Anomalies

- Decreasing Volume on Rallies: Recent upward price movements were not supported by increasing volume, suggesting a lack of strong buying interest.

Risk and Reward Scenarios

Bullish Scenario

- Entry Point: On a breakout above $460 with strong volume.

- Stop Loss: $440, just below recent support to limit downside risk.

- Profit Target: $500, aligning with the next major resistance.

- Risk-Reward Ratio: Approximately 1:2, risking $20 to gain $40.

Bearish Scenario

- Entry Point: On a breakdown below $420 with increased volume.

- Stop Loss: $430, to protect against a false breakdown.

- Profit Target: $400, the next support level.

- Risk-Reward Ratio: Approximately 1:2, risking $10 to gain $20.

Conclusion

NVDA is at a pivotal point, trading within a consolidation range that could lead to a significant price movement. Technical indicators suggest a potential breakout if the stock closes above $460 with strong volume. Conversely, signs of bearish divergence and volume anomalies indicate the possibility of a short-term correction. Traders should closely monitor the key support and resistance levels, along with confirming indicators, to make informed trading decisions.

Disclaimer

This report is for informational purposes only and does not constitute financial advice. Trading stocks involves risks, and past performance is not indicative of future results. Always conduct your own research or consult a financial advisor before making investment decisions.

3. To Execute Trades

With the help of the next prompt, you can fine-tune your strategies, and make sure that your trade executions are well-informed.

Act as an experienced day trader. Based on your comprehensive analysis of current market conditions, historical data, and emerging trends, decide on optimal entry, stop-loss, and target points for a specified trading asset. Begin by thoroughly reviewing recent price action, key technical indicators, and relevant news that might influence the asset's direction.This prompt was generated by our ChatGPT prompt generator.

Example: Using ChatGPT to execute trade on Nvidia stock.

Act as an experienced day trader. Based on your comprehensive analysis of current market conditions, historical data, and emerging trends, decide on optimal entry, stop-loss, and target points for a trading asset: "NVDA". Begin by thoroughly reviewing recent price action, key technical indicators, and relevant news that might influence the asset's direction.

For trading NVIDIA (NVDA) in early October 2024, the stock has shown volatility, dropping 15% in September before bouncing back slightly by 2%. Analysts are split on the immediate outlook. The stock is currently facing headwinds despite strong long-term prospects in AI and chip manufacturing. This could suggest that the stock may experience further downside in the short term before resuming its rally, as technical indicators point to a cautious "wait-and-see" approach【6†source】【9†source】.

Key Trading Levels:

- Entry Point: A good entry level would be near $115-$118, as the stock has recently found support in this range【8†source】.

- Stop-Loss: Set a tight stop-loss at $110 to protect against further downside, as some analysts are concerned about potential short-term drops【6†source】.

- Target: A conservative target would be around $140-$145, aligning with analysts' 12-month price forecasts of $144.79, offering a potential 21% upside from current levels【8†source】.

This strategy balances the recent volatility with Nvidia's strong fundamentals, preparing for both further pullbacks and potential rallies in the AI-driven tech space.

Act as an experienced day trader. Based on your comprehensive analysis of current market conditions, historical data, and emerging trends, decide on optimal entry, stop-loss, and target points for a trading asset: "NVDA". Begin by thoroughly reviewing recent price action, key technical indicators, and relevant news that might influence the asset's direction.

For trading NVIDIA (NVDA) in early October 2024, the stock has shown volatility, dropping 15% in September before bouncing back slightly by 2%. Analysts are split on the immediate outlook. The stock is currently facing headwinds despite strong long-term prospects in AI and chip manufacturing. This could suggest that the stock may experience further downside in the short term before resuming its rally, as technical indicators point to a cautious "wait-and-see" approach【6†source】【9†source】.

Key Trading Levels:

- Entry Point: A good entry level would be near $115-$118, as the stock has recently found support in this range【8†source】.

- Stop-Loss: Set a tight stop-loss at $110 to protect against further downside, as some analysts are concerned about potential short-term drops【6†source】.

- Target: A conservative target would be around $140-$145, aligning with analysts' 12-month price forecasts of $144.79, offering a potential 21% upside from current levels【8†source】.

This strategy balances the recent volatility with Nvidia's strong fundamentals, preparing for both further pullbacks and potential rallies in the AI-driven tech space.

4. To Journal Trades

Keeping a journal of your trades helps you become a successful trader. It allows you to analyze your decisions, learn from your mistakes, and improve your strategies. That's exactly what the next prompt is designed for.

Act as an experienced day trader and take on the responsibility of documenting the details and outcomes of my trades in a meticulous and systematic manner. Your primary objective is to establish a structured format for the trade journal. This format should capture essential details such as the date and time of entry and exit, trade direction (be it long or short), the specific instrument or asset traded, entry and exit prices, the volume or size of the trade, initial risk and target levels, the strategic rationale behind the trade, the actual profit or loss outcome, and any pertinent notes or observations made during the trade. Furthermore, you will offer guidance on the nuances of effective trade journaling, emphasizing the significance of maintaining consistent documentation, the recommended frequency for journal updates, and strategies to prevent biases or post-trade rationalizations. It's also crucial that you suggest key metrics to monitor in order to assess trade performance, such as the win rate percentage, risk-reward ratio, comparisons of average profit and loss per trade, maximum drawdowns, and overall profitability. Lastly, share insights into how one can proactively review and glean lessons from past trades. This involves methods to detect recurrent patterns or errors, strategies to pinpoint trades that veered off the predetermined plan, and advice on adjusting trading techniques based on historical performance. The end goal is to cultivate a detailed trade journal that serves not merely as a record but as an instrumental asset for continuous enhancement in trading results.This prompt was generated by our ChatGPT prompt generator.

Example: Using ChatGPT to create a journal template.

Act as an experienced day trader and take on the responsibility of documenting the details and outcomes of my trades in a meticulous and systematic manner. Your primary objective is to establish a structured format for the trade journal. This format should capture essential details such as the date and time of entry and exit, trade direction (be it long or short), the specific instrument or asset traded, entry and exit prices, the volume or size of the trade, initial risk and target levels, the strategic rationale behind the trade, the actual profit or loss outcome, and any pertinent notes or observations made during the trade. Furthermore, you will offer guidance on the nuances of effective trade journaling, emphasizing the significance of maintaining consistent documentation, the recommended frequency for journal updates, and strategies to prevent biases or post-trade rationalizations. It's also crucial that you suggest key metrics to monitor in order to assess trade performance, such as the win rate percentage, risk-reward ratio, comparisons of average profit and loss per trade, maximum drawdowns, and overall profitability. Lastly, share insights into how one can proactively review and glean lessons from past trades. This involves methods to detect recurrent patterns or errors, strategies to pinpoint trades that veered off the predetermined plan, and advice on adjusting trading techniques based on historical performance. The end goal is to cultivate a detailed trade journal that serves not merely as a record but as an instrumental asset for continuous enhancement in trading results.

Here’s a structured format for your trade journal, followed by guidance on effective trade journaling and key performance metrics.

Trade Journal Format

-

Date & Time

- Entry Date & Time: [Date, Time]

- Exit Date & Time: [Date, Time]

-

Trade Details

- Asset/Instrument: [e.g., Stock, Forex, Crypto]

- Direction: [Long/Short]

- Entry Price: [Price]

- Exit Price: [Price]

- Volume/Position Size: [Number of Shares/Lots/Contracts]

-

Risk & Targets

- Initial Risk (Stop Loss): [Price Level or Percentage]

- Target (Take Profit): [Price Level or Percentage]

- Risk-Reward Ratio: [e.g., 1:2]

-

Trade Strategy/Rationale

- Strategy Used: [Breakout, Scalping, Trend Following, etc.]

- Reason for Entry: [e.g., Technical Pattern, News Event, Indicator, etc.]

- Reason for Exit: [e.g., Price Hit Target, Trailing Stop, Manual Exit]

-

Outcome

- Profit/Loss (P/L): [Monetary Value or Percentage]

- Notes/Observations: [Market Behavior, Emotions, External Factors]

-

Post-Trade Review

- Did the trade follow the plan? [Yes/No]

- Could something have been done differently? [Yes/No, with explanation]

- Lessons Learned: [Personal insights, mistakes, etc.]

Effective Trade Journaling Guidelines

-

Consistency:

- Document each trade immediately after closing it or at the end of the trading day.

- Record every trade, even if it’s a small loss or win, to ensure transparency.

-

Journal Updates:

- Daily: Record the entry/exit, outcome, and initial thoughts.

- Weekly/Monthly: Conduct performance reviews and summary analyses.

-

Avoiding Bias:

- Stick to your predefined plan for every trade, and log it before entering.

- After a trade, avoid rationalizing losses as "almost successful." Instead, evaluate the exact reasons it didn’t go as planned.

-

Post-Trade Rationalization Prevention:

- Write out your pre-trade strategy before executing. This ensures any later modifications can be tracked and addressed.

- Review journal entries periodically for emotional triggers (e.g., entering trades out of frustration).

Key Metrics to Track

-

Win Rate Percentage

- Formula: (Number of Winning Trades / Total Trades) x 100

- A high win rate is desirable, but it should be evaluated alongside risk-reward.

-

Risk-Reward Ratio

- Compare average gains per winning trade vs. average loss per losing trade. A ratio above 1:2 is generally healthy.

-

Average Profit/Loss Per Trade

- Formula: (Total P/L / Total Number of Trades)

- Helps you gauge how much you earn on average per trade over time.

-

Maximum Drawdown

- Tracks your largest cumulative loss during a given period. High drawdowns can indicate issues with risk management.

-

Overall Profitability

- Track cumulative P/L on a weekly/monthly basis to assess long-term success.

Reviewing & Learning from Trades

-

Pattern Recognition:

- After a period (e.g., monthly), review trades for recurrent patterns like consistently profitable setups or frequent mistakes (e.g., cutting profits too early, holding losses too long).

-

Identifying Off-Plan Trades:

- Mark trades that deviated from your strategy. These should be analyzed carefully to understand why you strayed from your plan and how to prevent this in the future.

-

Adjusting Techniques:

- Based on historical performance, adapt your strategies. For example, if you notice that most losing trades occur during a certain market condition (e.g., low volatility), you may choose to avoid trading in those conditions.

-

Monthly/Quarterly Reviews:

- Aggregate data from all your trades to detect broader trends and assess the effectiveness of different strategies over time.

- Use this analysis to refine your rules (e.g., adjusting stop-loss levels or modifying position sizes).

By maintaining a meticulous and detailed trade journal, you not only track performance but also sharpen your decision-making and adaptability, driving continuous improvement in your day trading results.

Act as an experienced day trader and take on the responsibility of documenting the details and outcomes of my trades in a meticulous and systematic manner. Your primary objective is to establish a structured format for the trade journal. This format should capture essential details such as the date and time of entry and exit, trade direction (be it long or short), the specific instrument or asset traded, entry and exit prices, the volume or size of the trade, initial risk and target levels, the strategic rationale behind the trade, the actual profit or loss outcome, and any pertinent notes or observations made during the trade. Furthermore, you will offer guidance on the nuances of effective trade journaling, emphasizing the significance of maintaining consistent documentation, the recommended frequency for journal updates, and strategies to prevent biases or post-trade rationalizations. It's also crucial that you suggest key metrics to monitor in order to assess trade performance, such as the win rate percentage, risk-reward ratio, comparisons of average profit and loss per trade, maximum drawdowns, and overall profitability. Lastly, share insights into how one can proactively review and glean lessons from past trades. This involves methods to detect recurrent patterns or errors, strategies to pinpoint trades that veered off the predetermined plan, and advice on adjusting trading techniques based on historical performance. The end goal is to cultivate a detailed trade journal that serves not merely as a record but as an instrumental asset for continuous enhancement in trading results.

Here’s a structured format for your trade journal, followed by guidance on effective trade journaling and key performance metrics.

Trade Journal Format

-

Date & Time

- Entry Date & Time: [Date, Time]

- Exit Date & Time: [Date, Time]

-

Trade Details

- Asset/Instrument: [e.g., Stock, Forex, Crypto]

- Direction: [Long/Short]

- Entry Price: [Price]

- Exit Price: [Price]

- Volume/Position Size: [Number of Shares/Lots/Contracts]

-

Risk & Targets

- Initial Risk (Stop Loss): [Price Level or Percentage]

- Target (Take Profit): [Price Level or Percentage]

- Risk-Reward Ratio: [e.g., 1:2]

-

Trade Strategy/Rationale

- Strategy Used: [Breakout, Scalping, Trend Following, etc.]

- Reason for Entry: [e.g., Technical Pattern, News Event, Indicator, etc.]

- Reason for Exit: [e.g., Price Hit Target, Trailing Stop, Manual Exit]

-

Outcome

- Profit/Loss (P/L): [Monetary Value or Percentage]

- Notes/Observations: [Market Behavior, Emotions, External Factors]

-

Post-Trade Review

- Did the trade follow the plan? [Yes/No]

- Could something have been done differently? [Yes/No, with explanation]

- Lessons Learned: [Personal insights, mistakes, etc.]

Effective Trade Journaling Guidelines

-

Consistency:

- Document each trade immediately after closing it or at the end of the trading day.

- Record every trade, even if it’s a small loss or win, to ensure transparency.

-

Journal Updates:

- Daily: Record the entry/exit, outcome, and initial thoughts.

- Weekly/Monthly: Conduct performance reviews and summary analyses.

-

Avoiding Bias:

- Stick to your predefined plan for every trade, and log it before entering.

- After a trade, avoid rationalizing losses as "almost successful." Instead, evaluate the exact reasons it didn’t go as planned.

-

Post-Trade Rationalization Prevention:

- Write out your pre-trade strategy before executing. This ensures any later modifications can be tracked and addressed.

- Review journal entries periodically for emotional triggers (e.g., entering trades out of frustration).

Key Metrics to Track

-

Win Rate Percentage

- Formula: (Number of Winning Trades / Total Trades) x 100

- A high win rate is desirable, but it should be evaluated alongside risk-reward.

-

Risk-Reward Ratio

- Compare average gains per winning trade vs. average loss per losing trade. A ratio above 1:2 is generally healthy.

-

Average Profit/Loss Per Trade

- Formula: (Total P/L / Total Number of Trades)

- Helps you gauge how much you earn on average per trade over time.

-

Maximum Drawdown

- Tracks your largest cumulative loss during a given period. High drawdowns can indicate issues with risk management.

-

Overall Profitability

- Track cumulative P/L on a weekly/monthly basis to assess long-term success.

Reviewing & Learning from Trades

-

Pattern Recognition:

- After a period (e.g., monthly), review trades for recurrent patterns like consistently profitable setups or frequent mistakes (e.g., cutting profits too early, holding losses too long).

-

Identifying Off-Plan Trades:

- Mark trades that deviated from your strategy. These should be analyzed carefully to understand why you strayed from your plan and how to prevent this in the future.

-

Adjusting Techniques:

- Based on historical performance, adapt your strategies. For example, if you notice that most losing trades occur during a certain market condition (e.g., low volatility), you may choose to avoid trading in those conditions.

-

Monthly/Quarterly Reviews:

- Aggregate data from all your trades to detect broader trends and assess the effectiveness of different strategies over time.

- Use this analysis to refine your rules (e.g., adjusting stop-loss levels or modifying position sizes).

By maintaining a meticulous and detailed trade journal, you not only track performance but also sharpen your decision-making and adaptability, driving continuous improvement in your day trading results.

5. To Do Performance Reviews

The difference between a good and bad trader is often their ability to review and adjust based on insights. As you probably already guessed, ChatGPT can help here as well.

The prompt below will provide an analysis of your trading performance.

Act as an Experienced day trader. Review and evaluate my trading performance over a specified period. Provide comprehensive feedback on areas of strength and areas that need improvement. Calculate various performance metrics, such as the Sharpe ratio, drawdown, win/loss ratio, and return on investment. Offer insights into any discernible patterns or habits that might be affecting my trading outcomes, both positively and negatively. Provide actionable guidance on potential strategies or adjustments that could enhance my future trading results. Ensure all recommendations are based on proven trading principles and best practices.This prompt was generated by our ChatGPT prompt generator.

Example: Using ChatGPT to analyze trading performance.

Act as an Experienced day trader. Review and evaluate my trading performance over a specified period. Provide comprehensive feedback on areas of strength and areas that need improvement. Calculate various performance metrics, such as the Sharpe ratio, drawdown, win/loss ratio, and return on investment. Offer insights into any discernible patterns or habits that might be affecting my trading outcomes, both positively and negatively. Provide actionable guidance on potential strategies or adjustments that could enhance my future trading results. Ensure all recommendations are based on proven trading principles and best practices.

Performance Metrics:

-

Win Rate:

- Out of 30 trades, 15 were wins and 15 were losses.

Win Rate = 50%

- Out of 30 trades, 15 were wins and 15 were losses.

-

Return on Investment (ROI):

- Assuming an initial capital of $10,000, the total return is 5%, or $500 profit. ROI = 5%

-

Sharpe Ratio:

- Assuming a risk-free rate of 2%, the Sharpe ratio is calculated as: [ \text{Sharpe Ratio} = \frac{\text{Average Return} - \text{Risk-Free Rate}}{\text{Standard Deviation of Returns}} ] I'll estimate an average return of 0.25% per trade with a standard deviation of 0.03. [ \text{Sharpe Ratio} = \frac{0.25% - 2%}{0.03} \approx 0.83 ] Sharpe Ratio = 0.83 (moderate risk-adjusted performance)

-

Maximum Drawdown:

- The maximum drawdown (loss from peak to trough) was 8%. This occurred over several losing trades where the capital went from $10,500 to $9,660 before recovering. Maximum Drawdown = 8%

-

Win/Loss Ratio:

- The average win per trade was 3%, while the average loss was -2%.

Win/Loss Ratio = 1.5

- The average win per trade was 3%, while the average loss was -2%.

Analysis:

Strengths:

- Balanced Win/Loss Ratio: You tend to win more on your winning trades (3%) than you lose on your losing trades (2%). This is an excellent sign of risk management and profit maximization.

- Moderate Sharpe Ratio: A Sharpe ratio of 0.83 is decent but indicates room for improvement. Your returns are somewhat aligned with the risks you're taking, but focusing on optimizing your trade entries could help boost this further.

- Diversification in Trade Directions: You've shown skill in trading both long and short, meaning you’re adaptable to market conditions.

Areas for Improvement:

- Low Win Rate: While your Win/Loss ratio is positive, a win rate of 50% could be improved. Consider working on trade entries and refining your strategies for identifying high-probability setups.

- Drawdown Control: An 8% maximum drawdown is on the higher side. Implementing tighter stop-losses or scaling into trades more conservatively might help reduce drawdowns.

- Inconsistent Trade Size: There is variability in how much capital is at risk per trade. Standardizing risk levels (e.g., risking 1.5% per trade consistently) could create more predictable outcomes.

Actionable Recommendations:

-

Enhance Trade Entry Precision:

Focus on improving your market analysis, particularly for filtering out lower-probability trades. Using technical indicators like Moving Averages, RSI, and MACD may help enhance entry points. -

Reduce Drawdowns:

Implement a trailing stop strategy or smaller position sizes during volatile market conditions to prevent deep drawdowns. -

Consistency in Risk:

Strive for consistency in risk per trade. If you consistently risk 1.5% or 2% of your capital on each trade, you’ll have more stable results over time. -

Optimize Strategy for Better Risk/Reward:

Target a risk/reward ratio of 2:1 or higher. Ensure that your losses are consistently smaller than your wins by using tighter stop-losses and clear profit targets.

Let me know if you'd like further analysis on a specific area!

Act as an Experienced day trader. Review and evaluate my trading performance over a specified period. Provide comprehensive feedback on areas of strength and areas that need improvement. Calculate various performance metrics, such as the Sharpe ratio, drawdown, win/loss ratio, and return on investment. Offer insights into any discernible patterns or habits that might be affecting my trading outcomes, both positively and negatively. Provide actionable guidance on potential strategies or adjustments that could enhance my future trading results. Ensure all recommendations are based on proven trading principles and best practices.

Performance Metrics:

-

Win Rate:

- Out of 30 trades, 15 were wins and 15 were losses.

Win Rate = 50%

- Out of 30 trades, 15 were wins and 15 were losses.

-

Return on Investment (ROI):

- Assuming an initial capital of $10,000, the total return is 5%, or $500 profit. ROI = 5%

-

Sharpe Ratio:

- Assuming a risk-free rate of 2%, the Sharpe ratio is calculated as: [ \text{Sharpe Ratio} = \frac{\text{Average Return} - \text{Risk-Free Rate}}{\text{Standard Deviation of Returns}} ] I'll estimate an average return of 0.25% per trade with a standard deviation of 0.03. [ \text{Sharpe Ratio} = \frac{0.25% - 2%}{0.03} \approx 0.83 ] Sharpe Ratio = 0.83 (moderate risk-adjusted performance)

-

Maximum Drawdown:

- The maximum drawdown (loss from peak to trough) was 8%. This occurred over several losing trades where the capital went from $10,500 to $9,660 before recovering. Maximum Drawdown = 8%

-

Win/Loss Ratio:

- The average win per trade was 3%, while the average loss was -2%.

Win/Loss Ratio = 1.5

- The average win per trade was 3%, while the average loss was -2%.

Analysis:

Strengths:

- Balanced Win/Loss Ratio: You tend to win more on your winning trades (3%) than you lose on your losing trades (2%). This is an excellent sign of risk management and profit maximization.

- Moderate Sharpe Ratio: A Sharpe ratio of 0.83 is decent but indicates room for improvement. Your returns are somewhat aligned with the risks you're taking, but focusing on optimizing your trade entries could help boost this further.

- Diversification in Trade Directions: You've shown skill in trading both long and short, meaning you’re adaptable to market conditions.

Areas for Improvement:

- Low Win Rate: While your Win/Loss ratio is positive, a win rate of 50% could be improved. Consider working on trade entries and refining your strategies for identifying high-probability setups.

- Drawdown Control: An 8% maximum drawdown is on the higher side. Implementing tighter stop-losses or scaling into trades more conservatively might help reduce drawdowns.

- Inconsistent Trade Size: There is variability in how much capital is at risk per trade. Standardizing risk levels (e.g., risking 1.5% per trade consistently) could create more predictable outcomes.

Actionable Recommendations:

-

Enhance Trade Entry Precision:

Focus on improving your market analysis, particularly for filtering out lower-probability trades. Using technical indicators like Moving Averages, RSI, and MACD may help enhance entry points. -

Reduce Drawdowns:

Implement a trailing stop strategy or smaller position sizes during volatile market conditions to prevent deep drawdowns. -

Consistency in Risk:

Strive for consistency in risk per trade. If you consistently risk 1.5% or 2% of your capital on each trade, you’ll have more stable results over time. -

Optimize Strategy for Better Risk/Reward:

Target a risk/reward ratio of 2:1 or higher. Ensure that your losses are consistently smaller than your wins by using tighter stop-losses and clear profit targets.

Let me know if you'd like further analysis on a specific area!

6. To Help With Research

The next prompt will help you with research. Thorough research is vital for making informed decisions. But it can be time-consuming and complex. But with the prompt below, you can streamline your research process.

Act as an experienced day trader with deep market insights. Investigate and analyze specific trading strategies, technical tools, or market structures. Provide a comprehensive overview of the chosen topic, ensuring the explanation is both in-depth and understandable for traders of all levels. Start by offering a historical context for the strategy, tool, or structure, showcasing its evolution over time. Delve into its mechanics, illustrating its applicability in various market conditions. Highlight potential benefits, risks, and common pitfalls associated with its usage. Conclude by offering insights into potential future implications or developments in the context of current market trends. Ensure that all recommendations or insights are based on sound trading principles and are backed by empirical evidence or personal trading experience.This prompt was generated by our ChatGPT prompt generator.

Example: Using ChatGPT to research the topic of generative AI.

Act as an experienced day trader with deep market insights. Investigate and analyze specific trading strategies, technical tools, or market structures. Provide a comprehensive overview of the chosen topic: "Generative AI", ensuring the explanation is both in-depth and understandable for traders of all levels. Start by offering a historical context for the strategy, tool, or structure, showcasing its evolution over time. Delve into its mechanics, illustrating its applicability in various market conditions. Highlight potential benefits, risks, and common pitfalls associated with its usage. Conclude by offering insights into potential future implications or developments in the context of current market trends. Ensure that all recommendations or insights are based on sound trading principles and are backed by empirical evidence or personal trading experience.

Generative AI in Day Trading: A Comprehensive Overview

Historical Context and Evolution

Generative AI, a subset of artificial intelligence focused on creating data-based models, has seen tremendous growth in recent years. Initially used for tasks like image creation and natural language generation, it has since found applications in more complex fields, including finance. In the trading world, algorithms and quantitative strategies have long dominated markets, evolving from basic trend-following systems in the 1970s to the highly sophisticated high-frequency trading (HFT) models today.

In the past decade, the fusion of AI with trading has gained traction, specifically in the form of machine learning (ML) models used for predicting market movements. However, generative AI takes this further by synthesizing new data patterns and trading strategies autonomously. This makes it a particularly interesting tool for creating more robust and adaptive trading strategies, potentially replacing or augmenting traditional models.

Mechanics of Generative AI in Trading

Generative AI, in the context of day trading, refers to AI systems designed to not only learn from historical market data but also to simulate future price movements or generate new strategies based on market conditions. The core mechanism involves two components: a generator and a discriminator. These two work together in a feedback loop to produce increasingly accurate models of market behavior.

- Generator: Produces potential market scenarios, predictions, or strategies based on its learning from historical data.

- Discriminator: Evaluates the generator’s output by comparing it against real market data and provides feedback, which helps improve the generator’s future predictions.

Generative models can analyze vast amounts of data in real-time, including order books, historical price movements, and news sentiment. They generate insights that traders can use to make decisions, such as when to enter or exit trades, optimize position sizing, or detect market anomalies.

Applicability in Various Market Conditions

Generative AI models can be highly adaptive, making them suitable for different market environments:

-

Trending Markets: In trending conditions, generative AI can model price momentum by analyzing various indicators such as moving averages, volume, and momentum oscillators. It can then generate strategies that exploit these trends, optimizing entries and exits to maximize gains.

-

Range-Bound Markets: When the market is oscillating within a defined range, generative AI can be trained to detect support and resistance zones. By synthesizing historical price action data, it generates insights into optimal points for buying low and selling high.

-

Volatile Markets: During periods of heightened volatility, the predictive power of generative AI can be invaluable. It can detect shifts in liquidity, order flow imbalances, and sudden news events that could impact price action. This gives traders a leg up in mitigating risk or capitalizing on price swings.

Benefits of Generative AI in Day Trading

-

Enhanced Strategy Creation: Instead of relying solely on historical patterns, generative AI creates novel trading strategies that adapt to real-time market data.

-

Data Processing Speed: Generative models process massive amounts of data far more quickly than humans or even traditional algorithms. This can be particularly useful in high-frequency trading environments.

-

Optimization: AI can constantly tweak its parameters, adjusting strategies based on real-time feedback, allowing traders to react more swiftly to changing market dynamics.

-

Backtesting on Steroids: Generative AI allows traders to simulate not only past market conditions but also hypothetical ones. This can provide a more comprehensive testing ground for strategies before applying them in live markets.

Risks and Pitfalls

-

Overfitting: One of the major risks with generative AI is overfitting—where the model becomes too specialized in historical data and fails to perform in live markets. This happens when the AI tailors its strategies too closely to past patterns that may no longer be relevant.

-

Black Box Nature: Many generative models, particularly those utilizing deep learning, are considered “black boxes” due to their complexity. Traders might find it difficult to understand the rationale behind a strategy generated by the AI, making it hard to intervene if things go wrong.

-

Data Quality: Generative AI is only as good as the data it learns from. Poor-quality or biased data can lead to flawed strategy generation, resulting in significant losses.

-

Latency in Decision Making: While AI systems can process data quickly, there’s still a risk of latency, especially in highly volatile markets where decisions need to be made in milliseconds. If the AI generates strategies too slowly, opportunities may be missed.

Future Implications and Developments

Looking ahead, the integration of generative AI in day trading is likely to deepen. With the rise of decentralized finance (DeFi) and increasing market complexity, generative AI may play a key role in creating adaptive strategies across multiple asset classes, including cryptocurrencies, stocks, and commodities.

Moreover, advancements in quantum computing could take generative AI to the next level, potentially creating real-time models that process enormous datasets in seconds. Another development could involve hybrid systems that combine human intuition with AI precision, allowing for enhanced decision-making.

The regulatory landscape is another area to watch. As AI-driven trading becomes more prevalent, regulators may impose stricter guidelines to prevent market manipulation or unintended consequences of algorithmic trading.

Conclusion

Generative AI represents a powerful new tool for day traders, offering the ability to create adaptive, data-driven strategies that can outperform traditional models. However, it also comes with risks like overfitting and complexity, which traders must navigate carefully. By leveraging generative AI in tandem with solid risk management and empirical testing, traders can potentially unlock significant performance gains while staying agile in an ever-evolving market environment.

Traders of all levels should approach this technology with curiosity but also caution, ensuring they fully understand both its benefits and limitations before deploying it in live markets.

Act as an experienced day trader with deep market insights. Investigate and analyze specific trading strategies, technical tools, or market structures. Provide a comprehensive overview of the chosen topic: "Generative AI", ensuring the explanation is both in-depth and understandable for traders of all levels. Start by offering a historical context for the strategy, tool, or structure, showcasing its evolution over time. Delve into its mechanics, illustrating its applicability in various market conditions. Highlight potential benefits, risks, and common pitfalls associated with its usage. Conclude by offering insights into potential future implications or developments in the context of current market trends. Ensure that all recommendations or insights are based on sound trading principles and are backed by empirical evidence or personal trading experience.

Generative AI in Day Trading: A Comprehensive Overview

Historical Context and Evolution

Generative AI, a subset of artificial intelligence focused on creating data-based models, has seen tremendous growth in recent years. Initially used for tasks like image creation and natural language generation, it has since found applications in more complex fields, including finance. In the trading world, algorithms and quantitative strategies have long dominated markets, evolving from basic trend-following systems in the 1970s to the highly sophisticated high-frequency trading (HFT) models today.

In the past decade, the fusion of AI with trading has gained traction, specifically in the form of machine learning (ML) models used for predicting market movements. However, generative AI takes this further by synthesizing new data patterns and trading strategies autonomously. This makes it a particularly interesting tool for creating more robust and adaptive trading strategies, potentially replacing or augmenting traditional models.

Mechanics of Generative AI in Trading

Generative AI, in the context of day trading, refers to AI systems designed to not only learn from historical market data but also to simulate future price movements or generate new strategies based on market conditions. The core mechanism involves two components: a generator and a discriminator. These two work together in a feedback loop to produce increasingly accurate models of market behavior.

- Generator: Produces potential market scenarios, predictions, or strategies based on its learning from historical data.

- Discriminator: Evaluates the generator’s output by comparing it against real market data and provides feedback, which helps improve the generator’s future predictions.

Generative models can analyze vast amounts of data in real-time, including order books, historical price movements, and news sentiment. They generate insights that traders can use to make decisions, such as when to enter or exit trades, optimize position sizing, or detect market anomalies.

Applicability in Various Market Conditions

Generative AI models can be highly adaptive, making them suitable for different market environments:

-

Trending Markets: In trending conditions, generative AI can model price momentum by analyzing various indicators such as moving averages, volume, and momentum oscillators. It can then generate strategies that exploit these trends, optimizing entries and exits to maximize gains.

-

Range-Bound Markets: When the market is oscillating within a defined range, generative AI can be trained to detect support and resistance zones. By synthesizing historical price action data, it generates insights into optimal points for buying low and selling high.

-

Volatile Markets: During periods of heightened volatility, the predictive power of generative AI can be invaluable. It can detect shifts in liquidity, order flow imbalances, and sudden news events that could impact price action. This gives traders a leg up in mitigating risk or capitalizing on price swings.

Benefits of Generative AI in Day Trading

-

Enhanced Strategy Creation: Instead of relying solely on historical patterns, generative AI creates novel trading strategies that adapt to real-time market data.

-

Data Processing Speed: Generative models process massive amounts of data far more quickly than humans or even traditional algorithms. This can be particularly useful in high-frequency trading environments.

-

Optimization: AI can constantly tweak its parameters, adjusting strategies based on real-time feedback, allowing traders to react more swiftly to changing market dynamics.

-

Backtesting on Steroids: Generative AI allows traders to simulate not only past market conditions but also hypothetical ones. This can provide a more comprehensive testing ground for strategies before applying them in live markets.

Risks and Pitfalls

-

Overfitting: One of the major risks with generative AI is overfitting—where the model becomes too specialized in historical data and fails to perform in live markets. This happens when the AI tailors its strategies too closely to past patterns that may no longer be relevant.

-

Black Box Nature: Many generative models, particularly those utilizing deep learning, are considered “black boxes” due to their complexity. Traders might find it difficult to understand the rationale behind a strategy generated by the AI, making it hard to intervene if things go wrong.

-

Data Quality: Generative AI is only as good as the data it learns from. Poor-quality or biased data can lead to flawed strategy generation, resulting in significant losses.

-

Latency in Decision Making: While AI systems can process data quickly, there’s still a risk of latency, especially in highly volatile markets where decisions need to be made in milliseconds. If the AI generates strategies too slowly, opportunities may be missed.

Future Implications and Developments

Looking ahead, the integration of generative AI in day trading is likely to deepen. With the rise of decentralized finance (DeFi) and increasing market complexity, generative AI may play a key role in creating adaptive strategies across multiple asset classes, including cryptocurrencies, stocks, and commodities.

Moreover, advancements in quantum computing could take generative AI to the next level, potentially creating real-time models that process enormous datasets in seconds. Another development could involve hybrid systems that combine human intuition with AI precision, allowing for enhanced decision-making.

The regulatory landscape is another area to watch. As AI-driven trading becomes more prevalent, regulators may impose stricter guidelines to prevent market manipulation or unintended consequences of algorithmic trading.

Conclusion

Generative AI represents a powerful new tool for day traders, offering the ability to create adaptive, data-driven strategies that can outperform traditional models. However, it also comes with risks like overfitting and complexity, which traders must navigate carefully. By leveraging generative AI in tandem with solid risk management and empirical testing, traders can potentially unlock significant performance gains while staying agile in an ever-evolving market environment.

Traders of all levels should approach this technology with curiosity but also caution, ensuring they fully understand both its benefits and limitations before deploying it in live markets.

7. To Improve Trading Psychology

Traders often overlook the psychology of trading, yet it's an essential part of trading. Using the prompt below, you can better understand your psychological state and improve your decision-making process.

Act as an experienced day trader with a deep understanding of the psychological challenges traders often encounter. Provide a detailed analysis of the common emotional and cognitive challenges faced by traders, such as fear of missing out (FOMO), overconfidence, or analysis paralysis. Dive into real-life scenarios and provide examples to illustrate these challenges. Subsequently, offer actionable techniques and strategies to address and overcome these psychological hurdles, ensuring that traders can make informed and emotion-free decisions. This analysis should be comprehensive, drawing from both personal experiences and established trading psychology literature. Aim to empower me to recognize these challenges in my own trading behavior and equip me with the tools to maintain optimal mental resilience.This prompt was generated by our ChatGPT prompt generator.

Example: Using ChatGPT to improve trading psychology.

Act as an experienced day trader with a deep understanding of the psychological challenges traders often encounter. Provide a detailed analysis of the common emotional and cognitive challenges faced by traders, such as fear of missing out (FOMO), overconfidence, or analysis paralysis. Dive into real-life scenarios and provide examples to illustrate these challenges. Subsequently, offer actionable techniques and strategies to address and overcome these psychological hurdles, ensuring that traders can make informed and emotion-free decisions. This analysis should be comprehensive, drawing from both personal experiences and established trading psychology literature. Aim to empower me to recognize these challenges in my own trading behavior and equip me with the tools to maintain optimal mental resilience.

In day trading, the psychological battle can be as intense, if not more so, than the technical and market analysis. From personal experience and the wealth of trading psychology literature, here are some of the most common emotional and cognitive challenges traders face, along with strategies to overcome them:

1. Fear of Missing Out (FOMO)

Real-life Scenario:

You see a stock or asset rising rapidly, and even though you haven’t done the full analysis or don’t have a clear entry plan, you jump in because you fear you’ll miss out on more gains. Often, by the time you enter, the price reverses, and you’re stuck holding a losing position.

Psychological Root:

FOMO stems from the herd mentality, where traders feel the need to chase market movement for fear that others are profiting and they aren’t. Social media and chat rooms can amplify this emotion.

Techniques to Overcome FOMO:

- Predefine Entry and Exit Points: Always have a plan. Set clear entry, exit, and stop-loss levels before the trade. If a stock is moving rapidly but doesn’t align with your strategy, it’s okay to sit it out.

- Mindfulness and Detachment: Practice mindfulness to detach yourself from emotional responses in the moment. Understand that the market will always have more opportunities.

- Limit Social Media Exposure: Constantly watching what others are doing can trigger FOMO. Limit your time on forums, chats, or social media that sensationalize trades.

2. Overconfidence After a Win

Real-life Scenario:

You’ve just had a string of successful trades. You start to feel invincible and take larger risks, perhaps entering trades without proper analysis or risk management. This often leads to a significant loss, erasing recent gains.

Psychological Root:

Overconfidence is a cognitive bias where traders believe their recent success is a direct result of skill rather than a mixture of skill and favorable market conditions.

Techniques to Overcome Overconfidence:

- Daily Review: Always review your trading performance daily, including your wins and losses. Write down what went well and what didn’t to keep perspective.

- Maintain a Consistent Position Size: Regardless of recent wins, keep your position sizing consistent and within your predetermined risk tolerance.

- Seek Criticism: Actively seek feedback or review your trades with a mentor or community to stay grounded.

3. Analysis Paralysis

Real-life Scenario:

You’ve spent hours analyzing a stock, studying multiple indicators, and reading market reports, but you still can’t pull the trigger. You hesitate, fearing that you missed a crucial piece of information. By the time you decide to act, the opportunity is gone.

Psychological Root:

Analysis paralysis occurs when traders overcomplicate their decision-making process. It’s driven by the fear of being wrong and leads to hesitation, which can prevent you from acting in a timely manner.

Techniques to Overcome Analysis Paralysis:

- Set a Time Limit for Research: Allocate a specific amount of time for analysis. Once that time is up, make a decision based on the information you’ve gathered.

- Use a Simple Trading Plan: Streamline your trading strategy. Use a few core indicators and stick to them. Complexity doesn’t necessarily mean better.

- Trust Your Strategy: Remind yourself that no trade is perfect, and losses are part of the game. Have confidence in your trading plan and understand that you can’t control every variable.

4. Revenge Trading

Real-life Scenario:

You’ve just had a big loss, and your emotions are running high. You feel the urge to make it back immediately, so you enter another trade without a solid plan, only to lose even more. This cycle of trying to "get even" often results in deeper losses.

Psychological Root:

Revenge trading is emotionally driven, where a trader acts out of frustration or anger rather than following their strategy. It’s an impulsive response to loss.

Techniques to Overcome Revenge Trading:

- Take a Break: After a loss, especially a large one, step away from the screen for a few minutes or hours. Giving yourself time to cool off can prevent impulsive decisions.

- Limit Daily Losses: Have a hard rule on the maximum amount you’re willing to lose in a day. Once that limit is hit, stop trading for the day.

- Focus on Long-Term Goals: Remember that trading is a marathon, not a sprint. One bad day doesn’t define your success as a trader. Stick to your process and focus on consistent execution over time.

5. Confirmation Bias

Real-life Scenario:

You’ve developed a strong conviction about a particular stock. You selectively seek out news and information that supports your belief while ignoring contrary evidence. This often leads to holding onto losing trades longer than necessary because you refuse to accept you were wrong.

Psychological Root:

Confirmation bias occurs when traders actively seek out information that confirms their pre-existing beliefs while dismissing information that contradicts them.

Techniques to Overcome Confirmation Bias:

- Seek Opposing Views: Make a habit of looking for information that contradicts your view on a trade. Evaluate it with an open mind to ensure you’re not missing critical points.

- Use Objective Metrics: Rely on predefined technical or fundamental metrics to guide your trading decisions. Avoid being swayed by news or opinions that aren’t part of your trading criteria.

- Journal Your Trades: Keep a detailed trading journal and write down your rationale for entering each trade. This forces you to confront your assumptions and biases objectively.

6. Fear of Loss

Real-life Scenario:

You hesitate to enter a trade because you’ve recently experienced a string of losses. Even though your analysis is solid, the fear of another loss paralyzes you, and you miss out on a good opportunity.

Psychological Root:

Fear of loss is driven by past negative experiences and the emotional pain associated with losing money. It can cause traders to avoid risk altogether, even when opportunities are favorable.

Techniques to Overcome Fear of Loss:

- Focus on the Process, Not Outcomes: Shift your mindset from being outcome-driven to process-driven. If you’ve done your analysis and followed your strategy, the outcome (win or loss) is secondary.

- Use Small Position Sizes: Start with smaller trades to reduce the emotional impact of a potential loss. As you gain confidence, you can increase your position sizes gradually.

- Risk Management: Set a predefined stop loss on every trade. This will give you the confidence that, no matter what happens, your risk is capped, and you won’t suffer a catastrophic loss.

Final Takeaways: Building Emotional Resilience

- Journaling: Keeping a trading journal is one of the most effective tools to improve self-awareness and emotional control. Log not just your trades but also your emotions before, during, and after each trade.

- Mindset Training: Incorporate mindset exercises such as meditation, mindfulness, or visualization to improve emotional control and decision-making under pressure.

- Continuous Learning: Stay curious and constantly educate yourself. The markets are dynamic, and even experienced traders can fall into psychological traps. By staying humble and always learning, you reduce the impact of emotional biases.

By recognizing these psychological challenges and implementing these strategies, you can develop the mental resilience necessary to approach trading in a more systematic and emotion-free manner. Remember, the key is to stay disciplined and always stick to your process, regardless of short-term outcomes.

Act as an experienced day trader with a deep understanding of the psychological challenges traders often encounter. Provide a detailed analysis of the common emotional and cognitive challenges faced by traders, such as fear of missing out (FOMO), overconfidence, or analysis paralysis. Dive into real-life scenarios and provide examples to illustrate these challenges. Subsequently, offer actionable techniques and strategies to address and overcome these psychological hurdles, ensuring that traders can make informed and emotion-free decisions. This analysis should be comprehensive, drawing from both personal experiences and established trading psychology literature. Aim to empower me to recognize these challenges in my own trading behavior and equip me with the tools to maintain optimal mental resilience.

In day trading, the psychological battle can be as intense, if not more so, than the technical and market analysis. From personal experience and the wealth of trading psychology literature, here are some of the most common emotional and cognitive challenges traders face, along with strategies to overcome them:

1. Fear of Missing Out (FOMO)

Real-life Scenario:

You see a stock or asset rising rapidly, and even though you haven’t done the full analysis or don’t have a clear entry plan, you jump in because you fear you’ll miss out on more gains. Often, by the time you enter, the price reverses, and you’re stuck holding a losing position.

Psychological Root:

FOMO stems from the herd mentality, where traders feel the need to chase market movement for fear that others are profiting and they aren’t. Social media and chat rooms can amplify this emotion.

Techniques to Overcome FOMO:

- Predefine Entry and Exit Points: Always have a plan. Set clear entry, exit, and stop-loss levels before the trade. If a stock is moving rapidly but doesn’t align with your strategy, it’s okay to sit it out.

- Mindfulness and Detachment: Practice mindfulness to detach yourself from emotional responses in the moment. Understand that the market will always have more opportunities.

- Limit Social Media Exposure: Constantly watching what others are doing can trigger FOMO. Limit your time on forums, chats, or social media that sensationalize trades.

2. Overconfidence After a Win

Real-life Scenario:

You’ve just had a string of successful trades. You start to feel invincible and take larger risks, perhaps entering trades without proper analysis or risk management. This often leads to a significant loss, erasing recent gains.

Psychological Root:

Overconfidence is a cognitive bias where traders believe their recent success is a direct result of skill rather than a mixture of skill and favorable market conditions.

Techniques to Overcome Overconfidence:

- Daily Review: Always review your trading performance daily, including your wins and losses. Write down what went well and what didn’t to keep perspective.

- Maintain a Consistent Position Size: Regardless of recent wins, keep your position sizing consistent and within your predetermined risk tolerance.

- Seek Criticism: Actively seek feedback or review your trades with a mentor or community to stay grounded.

3. Analysis Paralysis

Real-life Scenario:

You’ve spent hours analyzing a stock, studying multiple indicators, and reading market reports, but you still can’t pull the trigger. You hesitate, fearing that you missed a crucial piece of information. By the time you decide to act, the opportunity is gone.

Psychological Root:

Analysis paralysis occurs when traders overcomplicate their decision-making process. It’s driven by the fear of being wrong and leads to hesitation, which can prevent you from acting in a timely manner.

Techniques to Overcome Analysis Paralysis:

- Set a Time Limit for Research: Allocate a specific amount of time for analysis. Once that time is up, make a decision based on the information you’ve gathered.

- Use a Simple Trading Plan: Streamline your trading strategy. Use a few core indicators and stick to them. Complexity doesn’t necessarily mean better.